Building a Better Member Experience: Core Modernization for a Regional Bank

The Federal Home Loan Bank of Cincinnati (FHLB-Cincinnati) provides critical financial services to more than 600 member institutions across Kentucky, Ohio, and Tennessee. Their mission centers on delivering reliable funding to support housing finance, affordable housing initiatives, community investments, and balance sheet management for their members.

A cornerstone of that mission is providing same-day access to liquidity through secured loans known as Advances. However, the process for applying for Advances was outdated and manual. Member institutions were required to submit applications via phone or fax, leading to inefficiencies, delays, and frustration for both members and internal teams. FHLB recognized the need to modernize the process with a secure, user-friendly digital solution.

With time to market as a priority, FHLB engaged Callibrity to accelerate the project and bring their digital vision to life.

Improved Member Experience

Streamlined Operations

Data-Driven Decisions

The Challenge

Complex, Inefficient Code Blocking Progress

Upon joining the project, Callibrity quickly identified significant challenges within the existing codebase. The application in development was overly complex, inefficient, and not aligned with the bank's long-term objectives. Continuing along the same path would result in ongoing delays and technical debt.

Callibrity recommended a modern, scalable approach, but this required demonstrating tangible value to justify abandoning the work already completed.

The Solution

Accelerated Delivery and a Proven, Scalable Platform

To build confidence and showcase the benefits of a fresh approach, Callibrity developed a working proof of concept in less than a week. The success of the proof of concept clearly illustrated the advantages of rethinking the codebase and realigning the project with best practices in software architecture and process modernization.

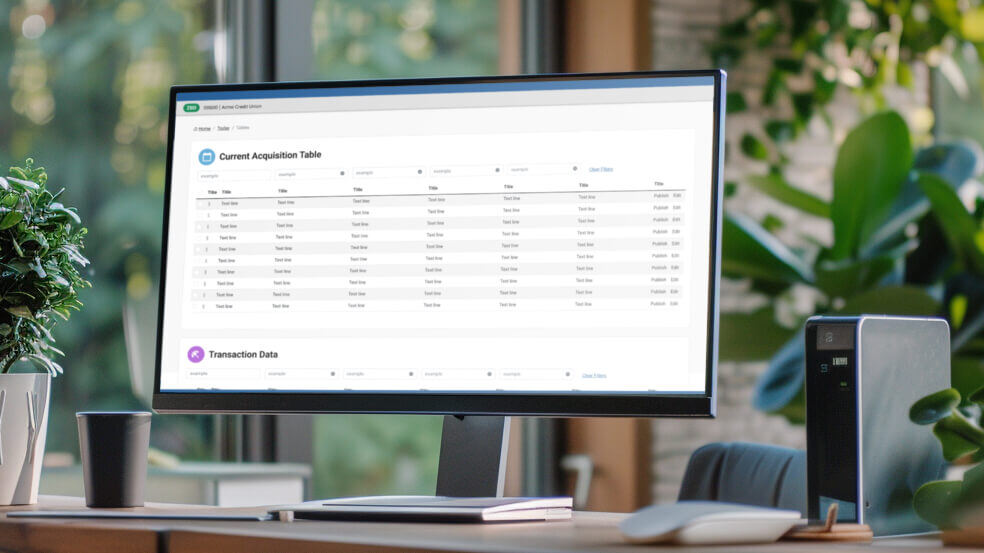

Within months, Callibrity delivered a robust, digital loan advances platform that transformed the manual process into an efficient, self-service experience for FHLB members. Through an intuitive online portal, members could apply for Advances quickly and securely, eliminating the need for outdated phone and fax submissions.

The impact of the solution was immediate. Forty-two percent of all Advances were initiated through the new digital channel, validating the effectiveness of the platform and the positive member experience it provided.

Callibrity’s solution reduced system complexity by consolidating over 400 files into just 150, simplifying maintenance and enabling future scalability. Code coverage increased to 90%, supported by a 100% success rate in testing, ensuring reliability and system integrity. Regression testing, which previously took over eight hours, now completes in under 10 minutes, dramatically improving development efficiency. Additionally, an executive dashboard was delivered, giving FHLB leadership access to real-time data and insights not previously available.

Lightweight Proof of Concept

Callibrity began by building a Proof of Concept (PoC) to help illustrate the potential of a fresh code approach. In less than a week, Callibrity completed a successful PoC that demonstrated the necessity of a rewritten codebase to get the project back on track and to lay the foundation for FHLB’s longer term objectives.

The Results

Partnership, Modernization, and Tangible Business Value

Callibrity’s engagement transformed FHLB’s digital loan advances process, providing operational efficiency, improved member satisfaction, and a scalable foundation for future growth. The project also strengthened the partnership between FHLB and Callibrity, built on collaboration, transparency, and shared success.

By modernizing outdated processes, improving user experiences, and delivering high-value technical solutions, Callibrity helped FHLB-Cincinnati achieve their mission more efficiently while positioning them for continued innovation.

Related cases

.svg) Case study

Case study